International remittances have long served as the engine of sending and receiving funds to/from the family or loved ones living abroad. With international migrations increasing for studies and work, cross-border payments have become a norm.

Leana Ferguson from JP Morgan in the report on the future of cross-border payments says that, “Ultimately, where we want to get to is the ability to instantly settle any payments in any currency, anywhere, anytime.”

Setting the bar one step higher. What if your customers can also make bill payments for their loved ones living abroad whenever and from wherever they are? Sounds interesting right? Well, this is now possible with “Cross border bill payments”.

But, what’s that? And how’s that possible? You will get answers to all here!

In this blog, you will explore:

- What are cross-border bill payments?

- How do cross-border bill payments work?

- Benefits of using cross-border bill payments in your remittance platform?

- Challenges associated with cross-border bill payments

- How DigiPay.Guru can help?

Roll up your sleeves and start reading the blog. Let’s begin with a basic understanding of cross border bill payments.

The basics of cross border bill payments

Let’s understand here the meaning of cross border bill payments first:

What are cross-border bill payments?

Cross border bill payments enable your customers to directly pay the bills for their family or loved ones living in another country. Cross-border bill payments are an essential feature of cross border payment solutions.

In other words, this feature allows you to offer your customers a seamless way to pay bills for loved ones living abroad. Having this feature in your platform will help you boost your revenue while adding an extra layer of convenience to your international remittance services.

Unlike traditional remittance, cross-border bill payments offer direct payment to service providers abroad. This provides peace of mind as the funds are used for their intended purpose.

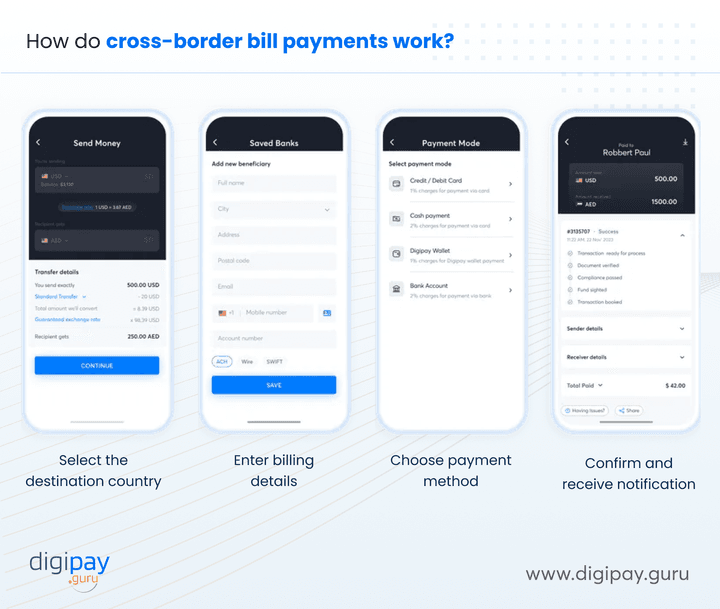

How do cross-border bill payments work?

Here’s how the cross border bill payments work for your customers:

Step 1: Select the destination country Your customers start by selecting the recipient's country from an intuitive list, and then they initiate a smooth cross-border bill payment process.

Step 2: Enter billing details Customers input the recipient's account and billing information to ensure accurate and secure payment processing.

Step 3: Choose payment method Next. they select their preferred payment method—bank transfer, card, or digital wallet. This offers flexibility and convenience.

Step 4: Confirm and receive notification After reviewing the details, customers confirm the payment and instantly receive a notification,. This ensures transparency and peace of mind.

What are some examples of cross-border bill payments?

There are numerous examples of international bill payments. Some common examples are:

- Paying utility bills like electricity, water, and gas for family members living overseas.

- Covering tuition fees for students studying abroad.

- Settling medical bills for relatives in other countries.

- Paying mortgages or rent on properties owned abroad.

- Subscribing to international services like insurance or digital streaming platforms.

These scenarios highlight the versatility and practicality of cross-border bill payments. This makes them essential in today’s globalized world.

What are the benefits of using cross-border bill payments in your remittance platform?

After getting a basic understanding of the cross border bill payments feature. If you are looking for the answer to why you should offer cross border bill payments in your cross border payments platform. These benefits are the answer to it.

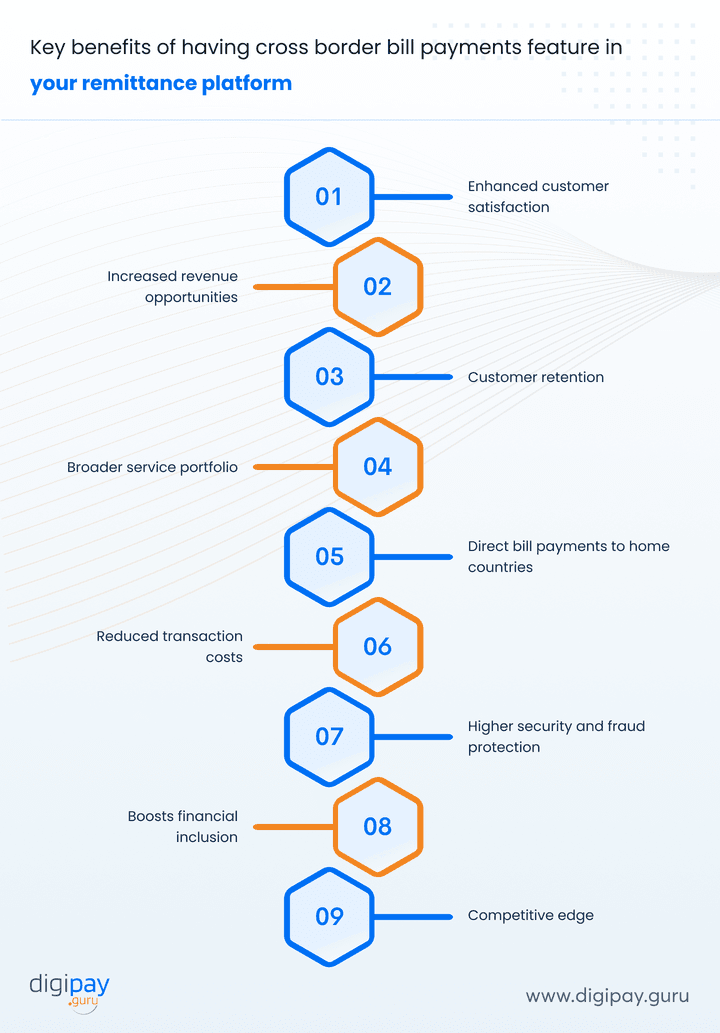

The benefits of having cross border bill payments in your remittance platform are:

Enhanced customer satisfaction

Customers value convenience. Cross-border bill payments eliminate the hassle of traditional money transfers and ensure bills get paid directly and on time. This feature enhances the user experience by providing a simple and efficient solution to a common problem.

- Direct payments to service providers save time.

- Users receive real time payment confirmations.

- Eliminates the risk of funds being misused.

Increased revenue opportunities

By offering international bill payments, you can earn additional revenue opportunities. For instance, you can earn through cross border payment fees for every transaction and currency exchange margins. .

This feature opens up new revenue streams without significant operational costs. And by leveraging these earnings, you can further invest in innovative solutions.

- Generate revenue through transaction fees.

- Earn from currency exchange margins.

- Low operational costs ensure higher profitability.

- Opportunity to introduce premium services.

Customer retention

Offering cross-border bill payments acts as an extra add-on feature that keeps your customers loyal. They’ll prefer your platform over others that lack this added value. If your customers stay loyal, they become your long-term customers and hence you get long-term profitability from them.

- Build long-term customer relationships.

- Reduce customer churn with value-added services.

- Enhance trust through reliable transactions.

- Increase repeat business by meeting customer needs.

Broader service portfolio

By integrating cross-border bill payments, you expand your service offerings. And a diverse portfolio attracts more customers and strengthens your market presence. This, in turn, increases revenue and enhances your brand reputation as a comprehensive remittance services provider.

- Appeal to a broader audience.

- Enhance your brand’s market presence.

- Attract businesses seeking advanced payment solutions.

- Stand out in a competitive market.

Direct bill payments to home countries

Many migrants send money home to pay bills. This feature simplifies that process, as it provides a direct and hassle-free solution to just pay bills. Means no need to transfer funds to anyone’s account, just paying directly to the biller.

This reduces the need for so many middlemen involved in it, which also minimizes the chances of errors/delays.

- Ensure bills are paid promptly and accurately.

- Avoid delays caused by intermediaries.

- Simplify the remittance process for users.

- Build trust with transparent transactions.

Reduced transaction costs

Cross-border bill payments often have lower fees compared to other international payment methods for remittance. This affordability appeals to cost-conscious customers. Additionally, streamlined processes and reduced intermediaries cut down operational expenses for your business.

- Attract customers with lower transaction fees.

- Reduce operational costs with automated processes.

- Offer competitive pricing to retain customers.

- Increase accessibility for cost-sensitive users.

Higher security and fraud protection

Direct bill payments minimize the risk of funds being misused. Plus, advanced encryption and secure payment gateways protect both the sender and recipient ‘s data and funds.

Moreover, enhanced security measures, like two-factor authentication and tokenization ensure that transactions are safe from fraud. Protect sensitive data with encryption.

- Prevent unauthorized access with two-factor authentication.

- Ensure secure transactions for peace of mind.

- Reduce instances of fraud and financial loss.

Boosts financial inclusion

This feature of bill payments helps unbanked or underbanked individuals pay their bills internationally. This bridges the gaps in financial services. By promoting financial inclusion, you can reach a broader customer base and contribute to the growth of the society.

- Offer easy access to basic financial services for the underserved and unbanked population.

- Support underserved communities with essential services.

- Expand your customer base in emerging markets.

- Promote economic growth through financial inclusion.

Competitive edge

Incorporating cross-border bill payments gives your business a unique selling point. It positions you as forward-thinking and customer-centric in a competitive market. Plus, staying ahead of the curve in offering innovative remittance solutions ensures sustained growth and relevance in the marketplace.

- Differentiate your platform from competitors.

- Highlight customer-centric innovations.

- Strengthen your market position.

- Ensure long-term growth and relevance.

Are there any challenges associated with cross-border bill payments?

Every coin has two sides. And so does the cross border bill payment feature. With so many benefits of the cross border bill payments, there are still certain drawbacks associated with it. They are as under:

Integration and technical issues

Integrating cross-border bill payments into your existing platforms may require technical expertise and significant resources. Ensuring compatibility with various payment systems and service providers is critical. Poor integration can lead to delays, errors, and dissatisfied customers.

Compliance and regulatory requirements

Cross border transactions requires to follow strict regulations and laws, such as KYC and AML standards. Plus, all these regulatory requirements are very complex and time consuming. You must invest in robust compliance systems to avoid legal and financial penalties.

Currency conversion risks and lack of transparency

Fluctuating exchange rates and hidden fees can impact the transaction’s cost. And there is a possibility that your customers may lose trust if they perceive a lack of transparency in fees or currency conversions. Hence, clear communication and competitive rates are essential to maintain customer confidence.

Read More - The role of Cross-border Payment System in boosting Financial inclusion

How DigiPay.Guru’s cross-border payment solution can help.

DigiPay.Guru offers a robust feature of cross border bill payments for your international remittance platform. This feature simplifies making bill payments across borders.

Advanced international remittance bill payment features

Multi-currency support: It enables your customers to may bill in any currency of the recipient country. Given that you have added those country corridors into your platform.

Automated reconciliation: Automatically match transactions with financial records to ensure accuracy, reduce errors, and streamline accounting across currencies and time zones.

Scheduled and recurring payments: Allow your customers to schedule payments or set up automatic recurring payments for cross border bills to ensure timely and convenient payments.

Configurable corridors: Tailor cross-border payment routes for different/specific countries. You can optimize cross border transactions based on local regulations and requirements.

Flexible payment methods: Offer your customers with multiple payment methods to pay bills, like cards, wallets, and bank transfers.

Support multiple bill types: Let your customers pay varied cross border bills for their loved ones.

These features empower businesses like yours to offer reliable and innovative international remittance services to your customers and meet the evolving needs of your customers.

Key capabilities of our international remittance solution

- Seamless integration

- Multi-currency support

- Real-time payments

- Secure transactions

- User-friendly interface

- Cost-effective services

- AML sanction screening

- Real-time performance tracking and insights

- Improved transfer speed with real-time routing and more…

Conclusion

Cross border bill payments are becoming a life safer for customers whose family members are abroad, especially those who are students. With this feature in your cross border payment platform you can boost revenue, enhance customer loyalty, and provide a significant competitive advantage.

DigiPay.Guru’s advanced cross-border payment solution offers the best-in-class cross border bill payments. It allows you to empower your customers to pay bills across borders for loved ones living abroad with ease and efficiency.

Plus, you can offer seamless payments for utilities, telecom, wifi, and more, while eliminating geographical barriers. And ensure instant, secure, and efficient cross-border transactions and bill management.

FAQ's

Cross-border bill payment allows users to pay bills directly to service providers in another country, covering expenses like utilities, tuition, or healthcare, without the need for a traditional money transfer.

To accept cross-border bill payments, partner with a reliable remittance solution provider like DigiPay.Guru. Integrate their platform with your existing system, ensure compliance with regulations, and provide a user-friendly interface for seamless transactions.

The main types include utility bill payments (electricity, water, gas), education fees, medical bills, mortgage or rent payments, and subscriptions to international services like insurance or streaming platforms.

Cross-border bill payments simplify paying bills overseas which offers convenience and security. They ensure timely payments, reduce errors, and provide peace of mind, which makes them essential for customers supporting families abroad.