The global remittance market is expected to reach $1588bn by 2033!

So, you already know the international remittance industry is huge. In fact, it's moving billions of dollars every month. This helps families survive, businesses grow, and economies thrive. But here’s what’s often missed in boardrooms today: “Agent networks are still doing the heavy lifting in emerging markets.”

Yes, digital wallets, mobile apps, and online portals are growing. But that doesn’t mean cash pickups or agent-driven payouts are going anywhere. If anything, managing your agent network efficiently is now mission-critical—especially when transaction volumes are rising and compliance is tightening.

Let’s get into why agent networks remain essential, what an agent network module in remittance can do, and how to manage it all without losing your sleep or money.

Why Agent Networks are Still Essential in a Digital Remittance World

Even though there is a rise in digital payment platforms for remittances, agent networks in remittance are not going anywhere.

Here's why they still matter and are still relevant:

The Enduring Relevance of Cash Pickups in Emerging Markets

Cash remains the leading payout choice in rural and underserved areas due to limited banking infrastructure, low smartphone penetration, and a general mistrust of digital remittance channels.

Such relevance of cash keeps agent networks an essential way for businesses like you to reach these populations.

Bridging the Digital Divide Through Agent Networks

There are many in rural areas who still lack internet access or digital literacy. Agent networks serve those without internet access or banking infrastructure, which ensures fast and reliable money delivery.

They reach remote and underserved communities where digital channels fall short. This makes cross-border remittances more inclusive, accessible, and immediate—regardless of location or connectivity.

Hybrid Approach: Digital + Agent = Wider Reach

Combining digital platforms with on-ground agents ensures you serve every customer type. Here, the agents are trained digitally so they can make cross-border payments for the customers’ loved ones.

Tech-savvy senders use mobile apps, while recipients in remote areas rely on trusted local agents for cash pickups.

Cash is Still King in Many Remittance Corridors

Cash payouts remain the go-to option across countries like Uganda, Bangladesh, and Peru. This is because banking infrastructures are still too poor in these regions.

So, in such areas, where there is poor mobile or banking access, agents bridge the gap to deliver funds quickly and reliably.

The Physical Presence of Agents Offers Accessibility, Trust, and Human Touch

A trusted remittance agent forms strong local bonds, which creates a sense of familiarity and comfort. These human interactions speed up remittance transaction processing and elevate brand trust, especially in regions where digital services feel distant or impersonal.

Regulatory Realities in Certain Regions Require Agent-Based Frameworks

In many regions, compliance regulations mandate physical agent involvement or licensed operator partnerships for legal international money transfer services. And fully digital remittance models often fail to meet these specific requirements. This limits their effectiveness in fully regulated corridors.

What is an Agent Network Module and Why is It a Game-Changer?

Agent networks in remittance are powerful. But when managed with spreadsheets, phone calls, and disconnected systems, they become complex.

That’s where an agent network module comes into the picture. Wondering what it is? Let’s explore its meaning, how it works, and its core capabilities.

Understanding the Agent Network Module

An agent network module in remittance is a centralized system that digitizes, manages, and automates your entire remittance agent network. It lets you:

-

Onboard agents

-

Monitor performance

-

Track transactions

-

Manage commissions

-

Ensure compliance

How an Agent Network Module Works

Agent network module helps remittance service providers like you to automate agent operations, meet regulatory demands, and improve service delivery.

1. Agent Onboarding: Registration becomes easier with digital forms, automated ID checks, and eKYC tools that verify agents instantly and securely.

2. Role Allocation: Assign access rights based on specific roles—cashiers handle transactions, supervisors oversee activity, and auditors review compliance logs.

3. Transaction Enablement: Allow agents to initiate, accept, or settle money transfer requests quickly and securely across supported corridors.

4. Compliance: Run instant KYC and AML checks, monitor risk, and meet local regulations—without juggling multiple systems or tools.

5. Monitoring: Monitor real-time agent activity, receive instant alerts, and access performance dashboards to improve transparency and operational decisions.

6. Reporting: Generate and export detailed transaction logs, agent activity summaries, and audit trails for compliance, analysis, and operational transparency.

The Core Capabilities

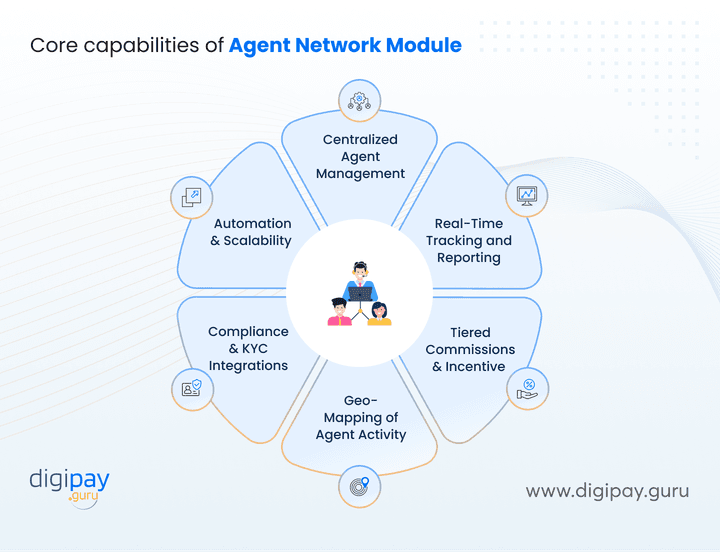

The core capabilities that make the agent network module a game-changer include:

Centralized Agent Management

Manage all agents from one dashboard—onboard, deactivate, assign roles, and track their performance effortlessly.

Real-Time Tracking and Reporting

Gain live visibility into agent activities, transaction statuses, and service performance with detailed, exportable reports and dashboards.

Tiered Commissions and Incentive Systems

Configure multi-level structures of agent commission in remittance to reward top-performing agents and motivate the network with transparent, automated incentives.

Geo-Mapping of Agent Activity

Visualize agent distribution and activity across corridors or regions to optimize coverage, performance, and expansion plans.

Compliance Enforcement and KYC Integrations

Enforce regulatory requirements automatically with built-in eKYC, AML monitoring, and instant alerts for suspicious behavior.

Automation and Scalability for Growth

Automate repetitive tasks, reduce manual errors, and scale your agent network effortlessly across borders, currencies, and jurisdictions.

Common Challenges in Managing Agent Networks

Even top-tier remittance service providers struggle with agent network complexities. Here are some common pain points.

Lack of Real-Time Visibility and Performance Tracking

Businesses like yours often struggle with the absence of real-time agent activity and performance tracking.

This lack of visibility

-

Delays decision-making

-

Causes inconsistent service delivery, and

-

Erodes trust among customers and regulators.

Without visibility, operational inefficiencies pile up, and your ability to intervene proactively is severely limited.

Manual Reconciliation Processes and Risk of Fraud

Using spreadsheets or paper logs for reconciliation:

-

Creates data silos

-

Increases human errors, and

-

Allows fraud to go undetected

Moreover, without automated audit trails, financial anomalies become difficult to identify. This makes fraud investigations time-consuming and costly for remittance service providers like you.

Fragmented Technology Stacks Leading to Inefficiencies

When agent operations, compliance, and transaction processing rely on disconnected systems, it leads to repetitive data entries, delayed updates, and operational chaos. Due to this, teams spend more time syncing data than solving problems. This causes service delays and increases the risk of compliance failure.

Poor Onboarding Processes and Compliance Gaps

Manual agent onboarding causes delays, missing documentation or errors, and agent drop-offs. Plus, inadequate eKYC processes can result in incomplete records and regulatory non-compliance. This leads to penalties and undermines your credibility in highly regulated remittance corridors.

Read more - Guarantee advanced security in customer onboarding with Digipay.Guru’s eKYC solution

The High Operational Cost of Scaling Agent Networks

Scaling through manual operations requires additional hires, training, and infrastructure investments. This slows down your expansion, increases costs, and diminishes margins—especially in emerging markets where low-cost scalability is critical to compete effectively.

How Agent Network Module Solves These Challenges

Let’s break down how the right Agent Network Module tackles each of these challenges head-on—giving you the control and clarity you need to operate efficiently and grow confidently.

Real-Time Visibility and Tracking

Without real-time data, you can not check the agent performance effectively, and hence you can not get an insight into the patterns of the customers. This, in turn, does not allow you to improve your services and offer the best service to your customers.

However, with a modern agent network module, you flip this switch. Here you can offer complete transparency across your entire agent network.

This enables

-

Dashboard-driven oversight across locations

-

Performance metrics at the agent and corridor level

-

And Real-time activity tracking and instant alerts

Eliminating Manual Reconciliation and Minimizing Fraud Risk

Manual reconciliation invites human error and hides fraudulent activity under layers of paperwork.

With automation, you get transparency, faster audits, and fewer surprises. It gives you capabilities like:

-

Digital transaction logs and audit-ready records

-

Automated reconciliation workflows, and

-

AI-powered fraud detection to flag suspicious transactions

Streamlining Fragmented Operations With a Unified Platform

Fragmented systems to manage agent networks can slow down operations, duplicate efforts, and increase errors.

So, a unified platform is the solution to these problems. Why? Because it connects the dots and allows for agent management within a unified platform. This allows your teams to focus on growth and not waste their time just syncing spreadsheets.

It gives you:

-

Single interface for agent management, compliance, and transactions

-

Centralized data across corridors and currencies

-

And seamless updates, reporting, and operational flows

Fast and Compliant Agent Onboarding

Complex and snail-speed agent onboarding, along with outdated compliance processes and tools, can slow down agent activation.

On the contrary, a digitized onboarding flow can efficiently cut down unnecessary delays and meet regulatory standards from day one.

It is possible through:

-

eKYC-backed registration and ID verification

-

Document uploads and background checks in minutes

-

Automated workflows that reduce manual review

Scalable, Low-Cost Agent Network Expansion

Scaling with manual processes is very complex. It can not only increase the agent management costs but also slow down momentum.

But with automation, you can expand into new markets without overextending your team or budget. This happens because automation gives birth to varied automated technologies like:

-

Self-service portals for agent signups

-

Workflow automation to reduce admin overhead

-

Built-in support for multi-currency, multi-country growth

Business Impact: What You Gain from an Agent Network Module

Investing in the right agent network module in remittance isn't just about technology—it's about driving real business outcomes.

When you streamline agent operations, you unlock scale, efficiency, and better service quality—all critical for staying ahead in today’s competitive remittance market.

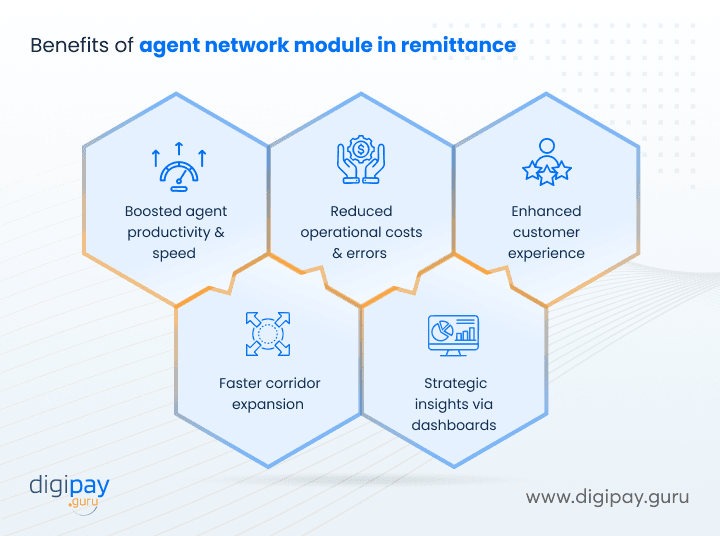

The key benefits that you get when you implement an agent network module include:

Boosts agent productivity and service speed

Equipped with digital tools, your agents can serve more customers in less time without compromising accuracy. This leads to faster remittance transaction processing and less crowding at pickup points.

Bottom line: More transactions, fewer delays—that’s a win for both agents and recipients.

Reduces operational costs and errors

Manual processes often come with high costs, high risk, and low visibility. With an agent network module, reconciliation is automated. This simplifies reporting and minimizes human error. In turn, this improves accuracy across every touchpoint.

Enhances customer experience and satisfaction

Reliable agents mean smoother transactions. When agents can serve quickly, accurately, and consistently, customers notice.

This leads to

-

Stronger trust & repeat business

-

Positive word-of-mouth in key remittance corridors.

Accelerates corridor expansion with minimal overhead

Growth doesn’t have to come with added complexity. The agent network module enables quick onboarding, centralized monitoring, and automated compliance checks. This way you can scale into new corridors quickly, without increasing back-office pressure.

Delivers strategic insights through real-time dashboards

Data becomes a strategic asset when you can view agent performance, cash flow trends, and corridor activity in real time. With real time dashboards, you can transform raw data into actionable insights and make quicker and more data-driven decisions across regions and teams.

Why DigiPay.Guru’s Agent Network Module Stands Out and Helps You

Managing agent networks isn’t just about technology—it’s about trust, compliance, and scale. And that’s exactly where DigiPay.Guru delivers.

Built specifically for the remittance industry, DigiPay.Guru’s Agent Network Module is designed to help banks, fintechs, and money transfer operators run their agent operations with total visibility, zero compliance gaps, and faster go-to-market execution.

Here’s what makes it different:

- Purpose-built for remittance operations

Not a generic CRM. This module is tailored for high-volume, cross-border remittance use cases with built-in features that address the real challenges on the ground.

- Real-time visibility

Instantly view agent locations, transaction activity, and performance across corridors—right from a single dashboard.

- Automated compliance and risk controls

Integrated eKYC, AML monitoring, and automated flagging help you stay audit-ready and regulator-approved in every corridor.

- Unified ecosystem integration

Seamlessly connects with your remittance platform, wallet system, payout services, and third-party APIs—no patchwork needed.

- Scalable, from startup to enterprise

Whether you're managing 50 agents or 5,000, the system scales effortlessly across countries, currencies, and regulatory environments.

- Frictionless onboarding and agent licensing workflows

Simplifies how new agents are onboarded and help them meet licensing requirements while streamlining activation across borders.

Conclusion

The remittance market is changing. But agent networks? They’re not fading; they’re evolving.

For remittance businesses like yours, the opportunity isn’t in replacing agents. It’s in empowering them with better tools. A robust Agent Network Module lets you eliminate inefficiencies, stay compliant, and scale faster—without the heavy overhead.

By modernizing your agent network, you can turn fragmented workflows into one seamless, real-time system. That’s how you serve more customers, enter new markets, and stay ahead of the curve.

All in all, agent networks aren’t a legacy—they’re your competitive advantage. DigiPay.Guru’s agent network module is specially designed for remittance businesses. So you can scale faster, operate smarter, and deliver cash pickup services where they’re needed most—securely, seamlessly, and successfully.

FAQ's

An Agent Network Module (ANM) is a digital system designed to manage and monitor your entire remittance agent network. It helps you onboard agents, track their performance, automate commissions, ensure compliance, and gain real-time insights. This then allows you to scale securely and efficiently.

Agent networks are crucial in regions with limited digital access, where cash remains dominant. Agents act as physical touchpoints for sending and receiving money, which makes remittance services more accessible, trustworthy, and inclusive—especially in rural or underserved areas.

The module connects all agents to your central platform. It enables digital onboarding, real-time transaction tracking, KYC compliance, commission automation, fraud detection, and data reporting. This ensures smooth operations and full visibility across your authorized remittance agent ecosystem.

Agents serve as your local representatives. They initiate or disburse remittance transactions, verify customer identities, handle cash-in/cash-out, and ensure compliance. Their role builds trust with users, especially in cash-heavy regions where personal interaction matters.

Agents are onboarded through a digital process that includes document submission, KYC/AML verification, training, and approval. With tools like DigiPay.Guru’s ANM, this entire process is automated. This helps you add compliant, ready-to-serve agents in just a few steps.

Advanced modules offer features like role-based access control, real-time transaction monitoring, geo-tagging, biometric verification, and audit trails. These tools help prevent fraud, monitor agent activity, and maintain regulatory compliance. This keeps your remittance operations safe and reliable.