Mobile payments have become very crucial due to their ease of making payments anytime, anywhere in the world. They have become so much in demand due to two reasons: the rise of mobile usage and internet connectivity.

But, there is another very importance reason. It is convenience. There are multiple types of mobile payments in the market, which makes it extremely convenient for users to use.

As a financial business, this is a great opportunity for you. You can offer a mobile payment platform with multiple payment options and become a preferred mobile payment service provider for your customers.

But, what are these mobile payments? And how does a mobile payment system can help you offer them seamlessly to attract more customers? To get answers to these questions, you need to first understand the basics and the important aspects of mobile payment systems.

In this blog, you will learn:

- What are mobile payment systems?

- Types and how they work?

- Must-have features in a mobile payment solution

- Benefits of mobile payment systems for your business

- How to integrate mobile payment systems with your business and more…

Let’s begin by understanding the basics of mobile payment systems

Basics of mobile payment systems

Did you know that the global mobile payment market size was valued at USD 1.25 trillion in 2024?

This stat says it all why mobile payment systems are the need of the hour for businesses like yours. So, with that in mind, let’s understand the basics of mobile payment systems first:

What are mobile payment systems?

A mobile payment system allows your customers to use their smartphones, tablets or other mobile payment devices to pay for goods and services. No cash or physical credit cards required. Payments are made through various methods such as mobile wallets, near-field communication (NFC), QR codes and direct bank transfers.

In mobile payment systems, payment data is stored securely on the device or in the cloud. When your customer makes a purchase, their device talks to your payment system to complete the transaction.

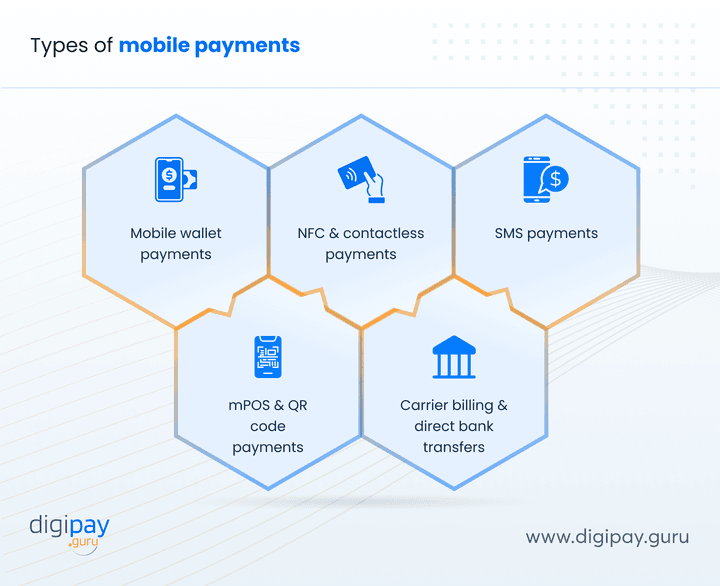

Types of mobile payments

Mobile payment systems come in various forms. Each of these mobile payment types offers different advantages depending on the needs of your business and customers.

Below are the most common types of mobile payments :

Mobile wallet payments

Mobile wallets are apps that store a user’s payment info securely. User can add their credit, debit or prepaid card details to the app, top up the wallet and use it for contactless payments at POS terminals.

Mobile wallet payment is a quick and secure way to pay without physical cards.

NFC & contactless payments

NFC (Near Field Communication) technology enables devices to communicate with each other when they are close together. Contactless payments use NFC to enable tap-and-go payments by adding a virtual card to the app or via an NFC enabled mobile app.

With NFC enabled mobile devices, your customers can pay by simply tapping their phone near a contactless payment terminal. This makes the entire transaction process faster for your customers.

SMS payments

SMS payments, also known as mobile billing, allow your customers to make payments through text messages. This system is commonly used for small transactions like buying digital content, apps, or services. It works by sending a payment request via SMS, and the payment is charged to the user’s phone bill.

mPOS & QR code payments

Mobile Point of Sale (mPOS) systems use smartphones or tablets to process payments. With the help of card readers connected to the device, mPOS solutions allow you to accept card payments on the go.

Similarly, QR code payments allow your customers to scan/upload QR codes provided by you and make payments through mobile payment apps. This facilitates easier checkout for your customers.

Carrier billing & direct bank transfers

Carrier billing allows users to charge payments directly to their mobile phone bill. This is especially popular in emerging markets where credit card usage is low.

On the other hand, direct bank transfers enable your customers to transfer funds directly from their bank accounts to the merchant’s account. This eliminates the need for intermediaries and speeds up the payment process.

How mobile payment systems works

Mobile payments are made such that they are fast and easy to make. But how do they actually work? Below is the simple step-by-step process of how mobile payment systems work:

Payment initiation: Your customer download the mobile payment app and opens it (e.g., mobile wallet or payment app).

Selects payment method: Then he chooses the payment method they want to use to make paymet (QR, NFC, Card, Wallet, etc)

Authorization: Next, the payment app authenticates the user through a PIN, fingerprint, or facial recognition to confirm the transaction is done by the legit user.

Merchant receives payment request: The merchant’s payment terminal communicates with the mobile payment app to request payment.

Payment processing: The payment is processed through a secure payment gateway or bank transfer, depending on the payment method chosen.

Transaction completed: Once the payment is approved, the merchant’s POS terminal or payment system provides confirmation of the transaction via SMS or within the app.

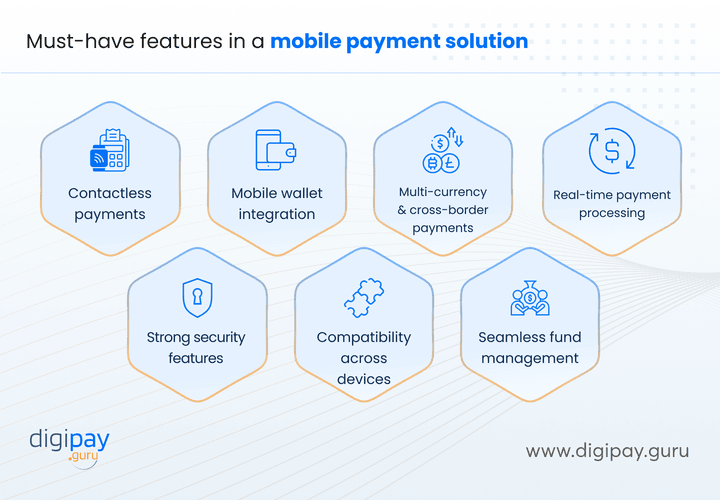

Must-have features in a mobile payment solution

When choosing a mobile payment system you must ensure it has these essential features:

Contactless payments

Enable your customers to complete transactions with a simple tap. This can reduce the payment processing time and improve overall customer satisfaction.

In addition to that, contactless payments also eliminate the need for physical interaction which makes them hygienic and efficient.

Read More - Top 7 Contactless Payments Trends to Keep an Eye on in 2025

Mobile wallet integration

Look for the mobiel payment system that allows your platform to seamlessly connect with popular mobile wallets as a payment method.

This integration ensures that customers can use their preferred payment method from one single platform (yours) . Due to this, the adoption rates of your platform rises and overall user experience is enhanced effectively.

Multi-currency & cross-border payments

If your business is operating globally or is planning to expand, you would need a system that can support multiple currencies and international payments. This feature can help you expand your customer reach and base.

Plus it can allow seamless international transactions to your customers without currency conversion problems.

Real-time payment processing

To be the best mobile payment service offering platform in the financial market, you must offer transactions that can be processed instantly without delays.

So you should look for a mobile payment system/solution that can help you offer real-time payments. This will enhance user confidence, reduce chargebacks, and allow you to manage cash flow effectively.

Strong security features

Implement robust security measures like end-to-end encryption, biometric authentication, and fraud detection. These features prevent unauthorized transactions and protect customer data from cyber threats.

Compatibility across devices

Look for a payment syetsm that can ensure that your mobile payment platform works on all smartphones, tablets, POS terminals, and wearables. This guarantees a smooth customer experience, regardless of the device being used.

Seamless fund management

Implement a system with a reporting dashboard. It allows your business to track transactions, analyze sales data, and manage funds effortlessly.

This feature is important for financial businesses looking to optimize operations and gain valuable business insights.

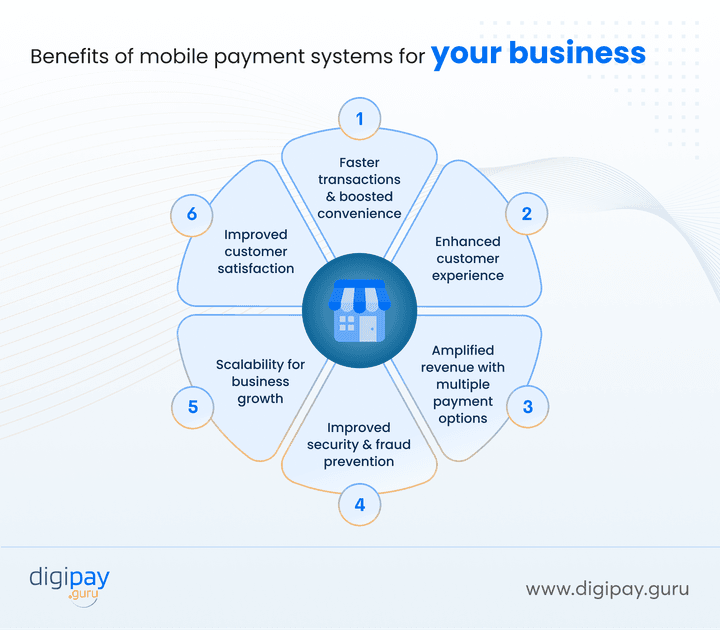

Benefits of mobile payment systems for your business

Implementing mobile payment systems into your business comes with numerous benefits. The key mobile payment benefits you get are:

Faster transactions & boosted convenience

Mobile payments eliminate long checkout lines and speed up transactions. With it, Your customers can simply tap, scan, or use their mobile wallets which makes the payment process effortless and time-efficient.

This helps because:

- Shorter transaction times mean improved efficiency and customer satisfaction.

- Contactless payments minimize physical contact, which makes them safer & more hygienic.

- Increased convenience encourages repeat business and boosts customer retention.

Enhanced customer experience

A seamless payment experience increases customer satisfaction and loyalty. By offering multiple mobile payment methods, you can cater to diverse preferences, which ensures a fast and frictionless payment process for your customers.

This helps because:

- Offering various payment options accommodates different customer preferences.

- A hassle-free checkout experience enhances customer satisfaction and brand trust.

- Faster payments lead to reduced wait times, which then, improves the overall shopping experience.

Amplified revenue with multiple payment options

Providing diverse payment options reduces cart abandonment and expands your customer base. Whether it's NFC, QR codes, or direct bank transfers, offering flexibility encourages more sales.

This helps because it:

- Reduces lost sales opportunities by offering flexible payment choices.

- Encourages impulse purchases due to seamless and quick transactions.

- Strengthens brand credibility with secure and well-recognized payment options.

Improved security & fraud prevention

Advanced security features such as biometric authentication, tokenization, and encryption protect transactions. Plus, real-time fraud detection prevents unauthorized access. All these mobile payment security measures keeps customer data and funds secure.

This results in:

- Reduced risks of chargebacks and fraudulent transactions.

- Ensured compliance with regulatory security standards.

- Enhanced customer trust in your payment system.

Scalability for business growth

As your business expands globally, a robust mobile payment system adapts to your needs. Moreover, multi-currency support and cross-border payments ensure seamless transactions in international markets as well.

This helps because it:

- Allows you to scale your operations efficiently without technical limitations.

- Supports cross-border payments for global expansion.

- Enables you to serve a broader customer base with minimal infrastructure changes.

Improved customer satisfaction

A hassle-free payment process enhances user experience and builds trust. When your customers can pay quickly and securely, they are more likely to return.

Thus, improved customer satisfaction helps in:

- Streamlining the payment experience while reducing frustration for customers.

- Encouraging repeat transactions and fosters brand loyalty.

- Simplifying payment tracking and management for both your business & your customers.

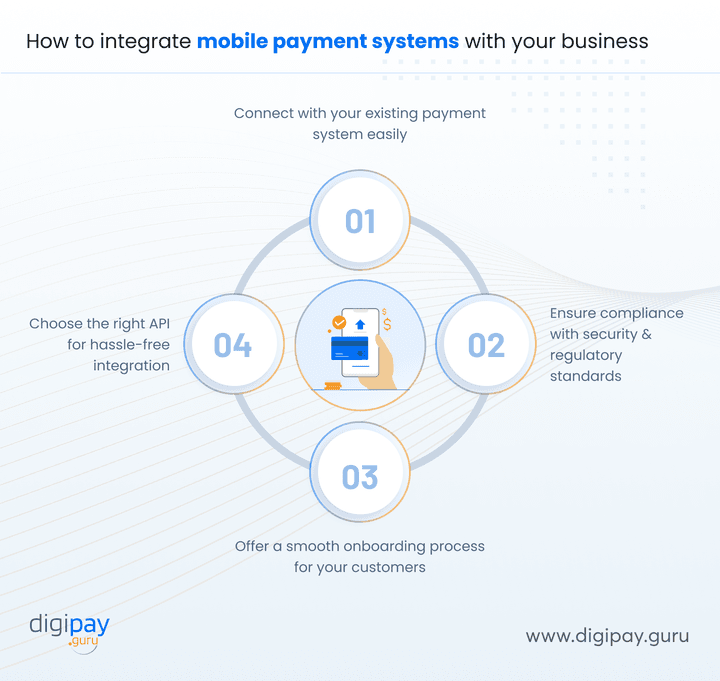

How to integrate mobile payment systems with your business

Integration is an important part of implementing a mobile payment system into your existing platform. How do you do that? Here’s how:

Connect with your existing payment system easily

Integrating a mobile payment system with your existing banking infrastructure ensures seamless transactions.

By connecting payment solutions with your payment network, you can provide users with real-time mobile payment processing and efficient account management.

Ensure compliance with security & regulatory standards

Compliance with financial regulations and stnadards is critical to build customer trust and protect the customer data and funds.

Ensure your mobile payment system meets global security standards like AML, KYC, PCI DSS and GDPR safeguards sensitive information and minimizes risks.

Offer a smooth onboarding process for your customers

A simple and user-friendly onboarding experience is crucial for your customers to adopt your platform and not your competitors.

So, you must ensure that your customers can easily register, set up accounts, and begin processing payments with minimal effort and guidance.

Choose the right API for hassle-free integration

A well-designed API makes integration with your existing systems very easy. This ensures secure and efficient payment processing for your customers.

So select a mobile payment system with a API that has robust documentation and support. This, in turn, will enhance scalability and minimize technical complexities for your business.

How mobile payment systems solution from DigiPay.Guru helps?

Want to find the perfect mobile payment system for your business? DigiPay.Guru is the right place for you.

DigiPay.Guru offers robust, secure and scalable mobile payment system for banks, fintechs, financial institutions, MTOs, NBFCs, Telcos and more. Our solution is - Money money payment solution or also called eWallet solution.

With our advanced eWallet solution, you can offer exceptional digital payment experience to your customers with like P2P payments, contactless payment, airtime top-up, etc.

With it, you get:

- Multiple transaction options (P2P (peer-to-peer) payments, P2M transactions, Utility bill payments & airtime top-ups)

- Varied modes of payments (QR payments, Tap & pay transactions, Phone number & SMS links)

- Seamless onboarding and KYC

- Building of agent network

We also offer advanced mobile payment systems:

Digital wallet: Offer secure and reliable digital mobile payment services to your customers with our advanced digital wallet solution. Your customers do not have to store funds in the wallet.

Agency banking: Empower your business to make banking services available anywhere to their customers and expand customer base quickly with the most reliable agency banking solution.

International remittance: Offer faster, affordable, interoperable, and transparent cross-border payment services to your customers with our end-to-end international remittance solution.

Conclusion

Mobile payment systems can make your payment services extremely fast, secure, reliable, scalable, and convenient for your customers. Hence, know its features, benefits and integration are crucial. Now that you read the blog, you must have gained all the valuable insights you were looking for about the mobile payment systems.

Now its your time to implement the best mobile payment system like DigiPay.Guru into your mobile platform. As a trusted provider, DigiPay.Guru delivers secure, scalable, and customized mobile payment solution tailored to your business needs.

Plus, our advanced platform ensures effortless integration and future-ready payment processing. All this, can help you gain a competitive edge, boost profits, and become a business leader.

FAQ's

Mobile payment is a digital transaction method that allows your customers to make payments using their smartphones or other mobile devices. Instead of relying on cash or physical cards, they can pay securely through mobile wallets, contactless payments, or QR codes. By offering mobile payment services, you can provide your customers with a fast, seamless, and secure way to complete transactions.

An example of mobile payment is when your customers use a mobile wallet like Apple Pay, Google Pay, or Samsung Pay to make purchases. For instance, if they tap their smartphone on a POS terminal instead of swiping a card, that’s a mobile payment. Other examples include QR code-based payments, in-app transactions, and direct transfers through mobile banking apps.

Your customers can make mobile payments through:

- NFC (Near Field Communication) payments Customers simply tap their mobile device on a contactless POS terminal (e.g., Apple Pay, Google Pay).

- QR code payments Customers scan a QR code to complete a transaction (e.g., WeChat Pay, PayPal QR).

- Mobile wallet & in-app payments Customers store their payment details in a mobile wallet or use in-app payment methods for quick transactions (e.g., ride-hailing and food delivery apps).

Your customers can use mobile payments in various ways:

- In-store transactions – By tapping their phone on a contactless payment terminal.

- Online purchases – By selecting a mobile wallet at checkout.

- QR code payments – By scanning and paying instantly.

- In-app purchases – By securely storing their card details for one-click payments.

- Peer-to-peer transfers – By sending and receiving funds through mobile banking or wallet apps.